Scalable Solutions Tailored to Your Business Needs

Enhance player protection and drive customer sustainability

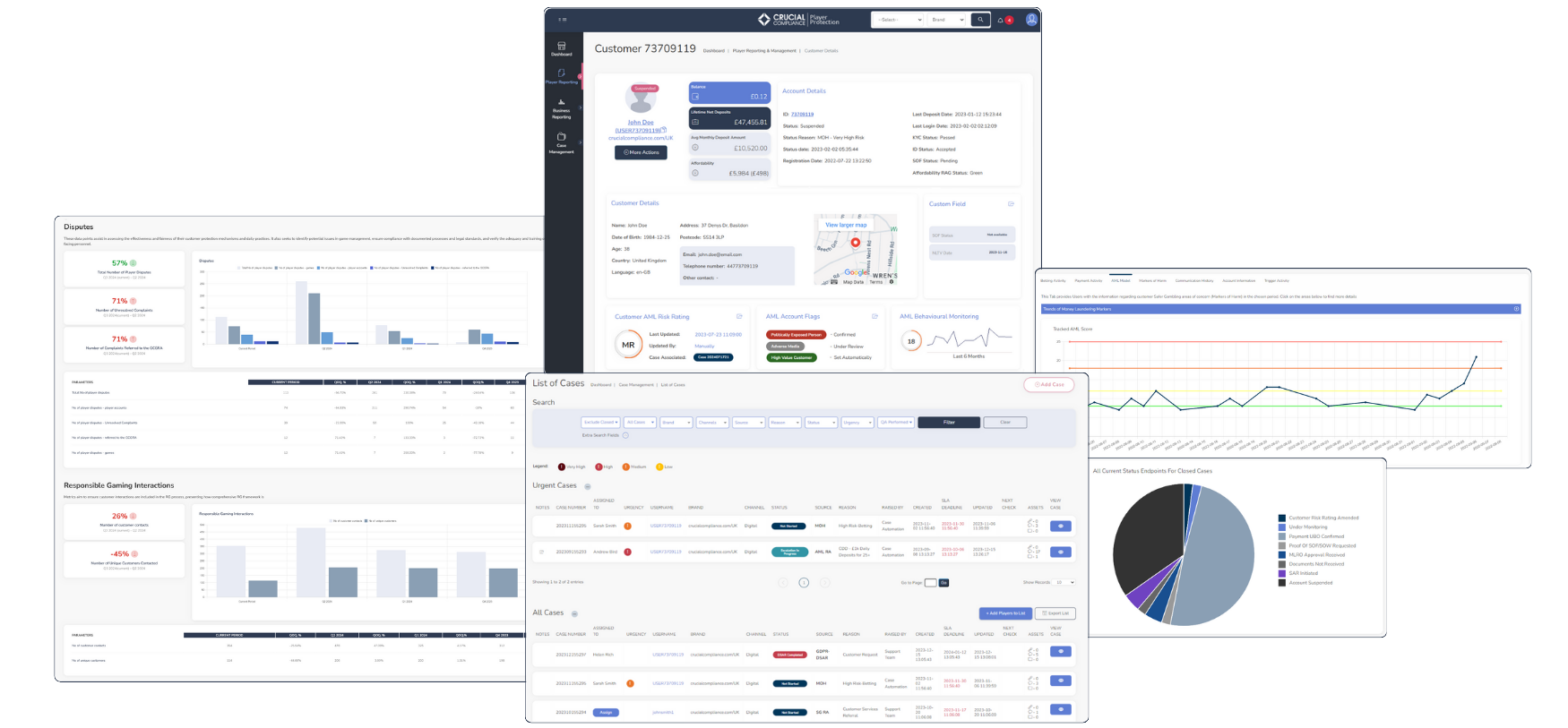

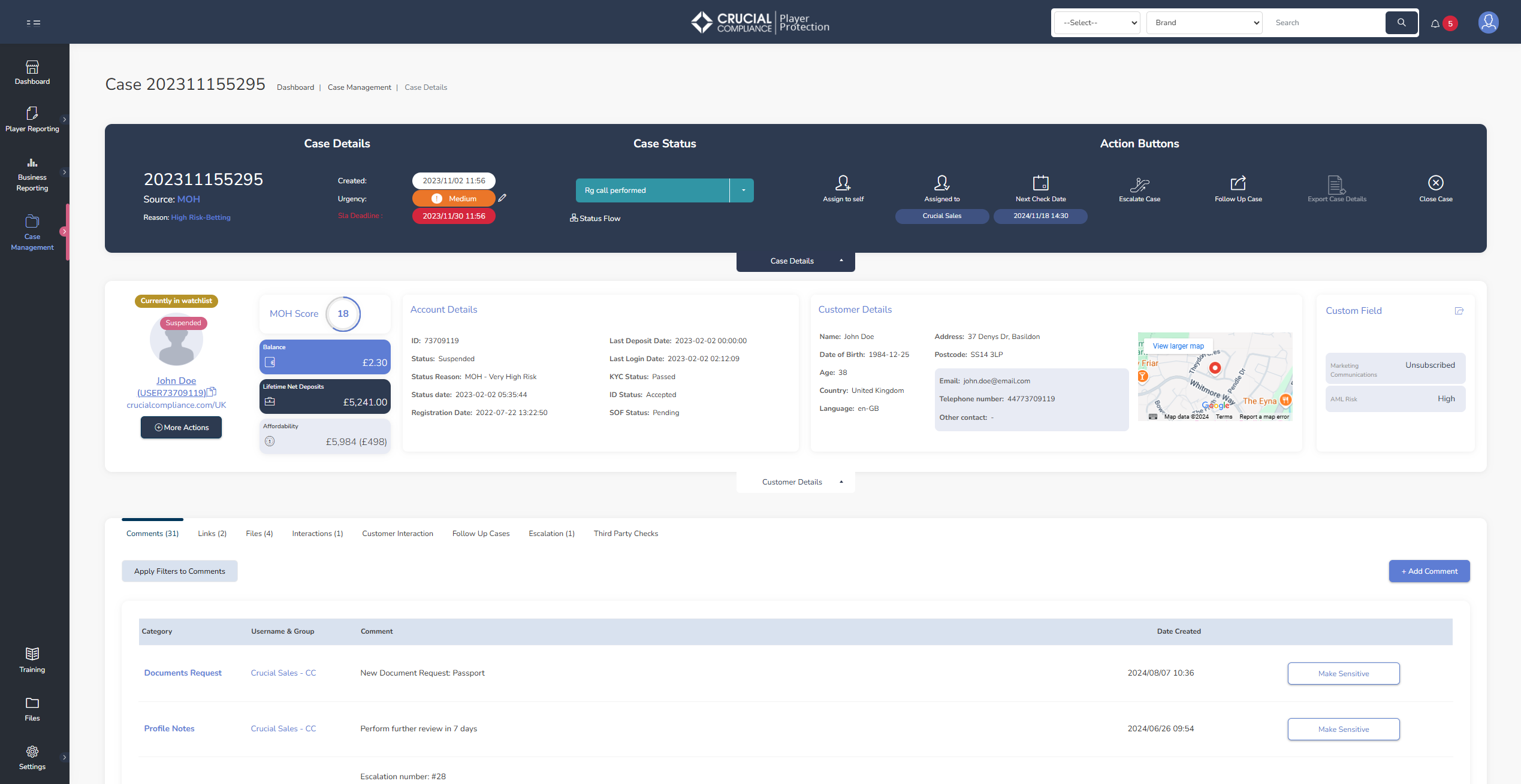

Adopt a holistic solution for end-to-end compliance and case management

Elevate AML operations with effective customer risk assessment

Crucial Compliance Models

Efficient Risk Identification and Mitigation with Advanced Markers of Harm and Anti-Money Laundering Models

-

Automated Triggers & CasesStreamline operations with minimal manual effort

-

Third-Party IntegrationCommunicate easily with your KYC, CRM, and other providers

-

Proactive ActionsAutomate risk-based account restrictions, suppression, and interactions

-

Customisable AlertsAdapt your existing processes for comprehensive risk management

-

Tailored UpdatesAlign the models with your risk appetite, compliance needs, and operations

-

Regulatory AlignmentStay updated with evolving laws and case studies

Crucial Markers of Harm Model

- Continuous monitoring of customer behaviour over time

- Detection of behavioural escalations compared to usual patterns

- Comparison of customer activity within peer cohorts

- Identification of individual indicators of harm

- Automated customer journeys tailored to specific risk groups

Crucial Anti-Money Laundering Model

- Continuous risk rating and transactional monitoring throughout the customer lifecycle

- Behavioural monitoring to detect patterns and changes over time

- Specialised AML bundles tracking money laundering typologies like mule accounts and smurfing

- Automated triggers for efficient investigations and risk assessments

- Risk-based approach tailored to regulatory standards and operator’s risk appetite

Crucial Risk Management Offers:

Full Audit Trail

Efficient Player Management

SLA and Next Check Date Set Up

Individual Case Flows

Case Management & Workload

Case & Player Escalation

Player Lists

Quality Assurance

User Management

Say goodbye to inefficient workflows and embrace streamlined compliance management

We understand the complexities of compliance operations. Our solution transforms challenges into seamless processes. The platform’s intuitive interface consolidates all the necessary components in one place, eliminating backlogs and enhancing the quality of account reviews by prompting thorough documentation